Brazil has always been a fascinating yet incredibly difficult market for airlines. The country is huge, but for years air travel was only for the wealthy. It has changed, but it is not a settled market by any means, as evidenced by the new plans for a blockbuster merger between Gol and Azul. Before talking about this combo, let’s take a trip back in time.

When I first visited Brazil in the late 1990s, the big three of Varig, Vasp, and Transbrasil were all fighting for dominance. None of them exist any longer.

The Changing of the Guard

Varig was the country’s long-time flag carrier, and it was a complete mess as you might expect. I remember once at a conference talking to someone from the airline who said it cost more to take a booking directly online than through a third party. There was no fixing that company, and it went away officially in 2008 after being in the throes of death for years. VASP was another long-time Brazilian carrier that failed in 2007. Transbrasil was the new kid on the block, dating back only to the 1950s. But it was the first to go in 2001.

How is it possible that a country’s three big airlines all fail in short order? Pressure came from the new kids in town. Throughout the 1990s, TAM had been slowly building its presence after consolidating smaller regionals and becoming more than just a small air taxi. It was 1997 when TAM ordered its first narrowbodies from Airbus. The airline became the biggest airline in Brazil in 2005, and by 2010 it merged with LAN to create the behemoth that we know today as LATAM.

While TAM was growing into the flag carrier role as a full-service airline, Gol had other plans. Gol started flying in 2001 as a hybrid, low-cost type of operator which has had a wobbly strategy over the years. At one point it wanted to be in an alliance. Then it aligned with Delta, selling a small stake to the airline. Now it’s aligned with American which itself now owns a small piece. It’s an all-737 operator that has the country’s most important markets well-covered.

The last player we need to talk about is Azul, started by JetBlue founder David Neeleman. Azul was built to serve markets others did not. Brazil was a young air travel market with huge potential, so Azul was all about stimulation in places that didn’t seem like viable markets previously. It started flying in 2008 and, as is always the case with a David Neeleman airline, it grew very fast. It just recently passed Gol as the second largest airline in Brazil flying everything from its original bread-and-butter Embraer 195 fleet all the way up to the A330neo for long-haul.

The Pandemic is Brutal for Brazil

During the pandemic, Brazilian carriers did not have the same access to funds that US carriers did, so they all were effectively bankrupt and scrambled to figure out a plan to stay alive. LATAM filed for Chapter 11 protection in the US in 2020, not wasting any time. Gol sold a majority of its shares to Abra Group (the parent of Avianca) in 2022, and that kept the airline going until early 2024 when it filed for bankruptcy itself. Azul didn’t have to file for bankruptcy since it was able to achieve an out-of-court restructuring of debt, but the situation has been dire at times.

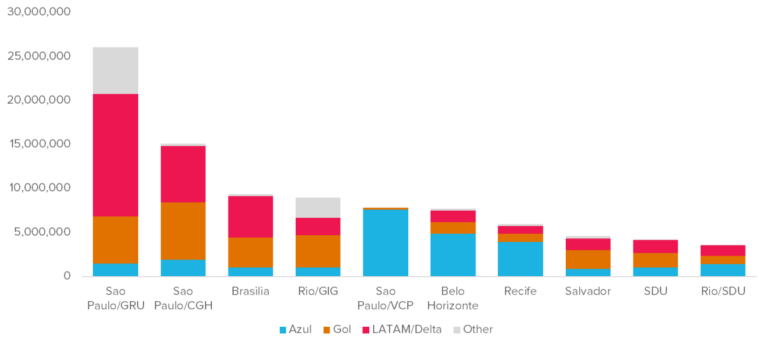

With a head start coming out of the pandemic with a clean balance sheet, LATAM came out swinging and has really doubled-down on winning the Brazilian market. At São Paulo’s primary Guarulhos airport, LATAM and joint venture partner Delta now control more than half of the airport’s traffic. At close-in Congonhas for short flights, LATAM is above 40% which is very close to what Gol flies. LATAM also controls the country’s capital, Brasilia, with just over half the seats.

Departing Seats for Top Brazilian Airports – FY 2024

Data via Cirium

Gol, meanwhile, relies heavily on its presence as a foil to LATAM at all of those airports, but it is also the biggest airline at Rio’s Galeão. Azul is in a different world with most of its capacity in São Paulo flying from Viracopos (Campinas). After that, its next largest operations are at Belo Horizonte and Recife. It’s the places where the others don’t fly that matter most for Azul.

Merger Time

With Gol working on exiting bankruptcy, dealmaker Abra has a plan. It has announced that it wants to merge Gol with Azul. Funny enough, it seems Gol didn’t actually even know that was a plan when it was announced. There is nothing binding here at all, but if it does go through, it will create a new largest airline in Brazil, leapfrogging over LATAM.

As you can see from the chart above, this would not have a huge impact on overlap. The networks are actually quite complementary in that respect. But naturally this does reduce the country from having three main airlines to two, so it’s impossible to do this without reducing competition to some extent.

The real question is whether this is a three-airline kind of a country or a two-airline one. The competition review will certainly address that. One thing that is clear, however, is that it has never been a particularly stable airline market.

For Abra, this would be huge. It already owns the Colombian market and has solidified its position. It also controls all of Central America, save Panama. A big move into Brazil like this would make it significantly more relevant.