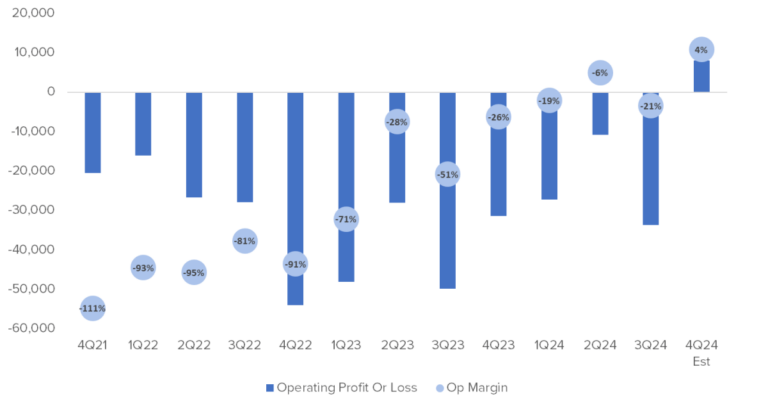

The press release screamed it from the mountaintop: “Breeze Airways Announces First Full Quarter of Operating Profit in 4Q2024.” This is a big milestone for the airline which, up until now, has been wildly unprofitable. But we don’t know everything yet, so it’s hard to know just how good this news is for the airline. Today, we’re going to dig in and see what we can pick apart.

The Department of Transportation requires airlines to report finances — even if they’re private companies that don’t otherwise have to report — but they have a delay on those numbers. Even though public airlines are reporting Q4 and full year 2024 numbers now, DOT has just recently put out Q3. And since Breeze isn’t public, it doesn’t have to say anything until DOT numbers come out.

Of course, Breeze WANTS to say something about Q4, because it posted an operating profit. It’s happy about that, but it only released select data. Here’s what we know that’s useful:

- generated more than $200 million in revenue in Q4 2024 and more than $680 million for the full year

- had an operating margin of more than 4 percent in Q4

So, let’s work with this. To start, here’s what the previous quarters look like since the airline began flying

Breeze Operating Results by Quarter

via DOT Form 41

Those last numbers in Q4 are estimated based on what they told us, but either way, it is a big improvement. Based on data from the first three quarters, we know that Breeze generated $477 million in revenue. Breeze now says it made over $680 million in revenue for the full year, and that means this would be $203 million in Q4… which is right around what they said in the press release. So far, so good.

I know that the airline said “more than” those revenue numbers, but let’s just assume it isn’t much over at all. In other words, let’s say that the airline generated $203 million in revenue, and its operating margin is 4 percent. Using math, that means expenses in Q4 were almost identical to what they were in Q3. This seems like a stretch.

If we look at capacity, Breeze in Q4 operated more than 10 percent more flights than it did in Q3 and 15 percent more block hours. Costs have to be higher in Q4. There is some offset, however. United and Delta both reported fuel price declines in Q4 vs Q3 of 6.25 and 7.5 percent respectively, so it’s likely Breeze saw fuel prices drop as well.

In Q3, Breeze had fuel costs of just over $51 million, but… let’s say that fuel prices dropped 7 percent. That drops the price of fuel, but remember the airline flew 15 percent more block hours. So the fuel expense would still be higher than in Q3 overall. This could mean that revenue was well over $203 million so it could cover the higher level of cost. Or something came out of costs in Q4 to offset the growing operation.

Anyway, I’m getting too bogged down here. I’m just trying to get to a number that makes sense, but it is definite that the airline made an operating profit of at least 4 percent. It isn’t lying about that, or if it is, then we’ll see how David Neeleman looks wearing an orange jumpsuit.

The real question is now just how far is Breeze from making an actual profit? Over the last several quarters, Breeze has added an enormous amount of “Other Interest Expense” to its non-operating numbers.

Breeze Financial Information By Quarter

via DOT Form 41

As you can see, this really escalated in Q2 and Q3 of last year. (This, by the way, happened after the guest post I published last year which is about other operating expenses. That was something completely different.)

What is this interest expense? Presumably it’s related to outstanding debt on aircraft financing or possibly something related to convertible debt. I’m not sure what it is, but it’s a thing that matters. How much? In Q3, it changed the operating margin of -21 percent to a net margin of -31 percent.

Clearly this is going to be a significant number in Q4, because otherwise Breeze would have announced a net profit instead of just an operating one. I just don’t quite know how to think about scaling that since we don’t have too many quarters of history.

Despite that, this is obviously a very big and positive change for Breeze. I find it surprising that Q4 is the first quarter where it posted an operating profit. That doesn’t seem like it would be a peak quarter. So maybe the momentum is there, and we’re going to see further, rapid improvement. Or maybe not. But I certainly can’t fault the airline for celebrating the wins. It should.