JetBlue has been a lot of things over the years, but most of all it’s been a point-to-point airline. It loves to fly people nonstop where they’re going, and if you want to connect, well, that’s a you problem. Connecting fares have never been very good, and flights weren’t timed for connections. But wait, things appear to be changing, at least a little. Does JetBlue actually want connections now? Yes it does.

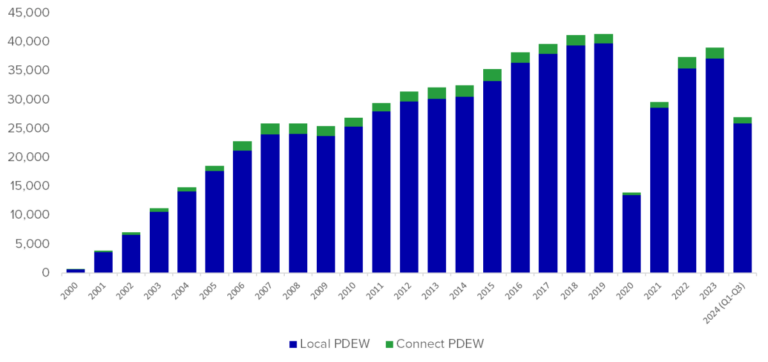

But before we talk about a change, we have to really understand how little JetBlue cares for connections. I went back through DB1B data to help demonstrate this point. Keep in mind this is only domestic data.

JetBlue Domestic Traffic Local vs Connect

Data via Cirium

As you can see, there is very little connecting traffic in the domestic JetBlue network, well under 10 percent since the beginning of time at that airline. Much of this has to do with network design, but it’s more than that. Fares have never been attractive for connections, and schedules haven’t been built to support them anyway. Further having a hub in the corner of the country doesn’t really lend itself to a useful hub. (Again, remember, I’m talking about domestic connections. We’ll talk about international in a bit.)

But I think we need to put this in context. Let’s compare to other airlines:

% Local Domestic Traffic by Airline for Q1-Q3 2024

Data via Cirium

Clear enough now? Yes, Allegiant has a smaller percent of connections, but you know why that is? It doesn’t sell connections. So, yeah. That would be hard to beat.

So what has changed or maybe should I say, what is changing? We do have to consider JetBlue’s growing footprint. When the airline entered the European market, it was clear that this wasn’t likely to work on local traffic alone. That’s just natural. This is using ARC/BSP data to look at traffic from the US to Europe where each airline listed is the dominant carrier:

% Local US-Europe Traffic by Airline for Q1-Q3 2024

Data via Cirium

If you’re flying the overwater long, that’s how you become the dominant carrier. So all those connections from JetBlue to other airlines don’t count. This suggests that only about half of JetBlue’s European flights are filled with locals while the rest are connecting.

That all makes sense, but now JetBlue is going further. This was in its recent summer network press release.

In addition to its growth in Boston, JetBlue is adding new New England routes from Providence, Rhode Island, and Hartford, Connecticut, to New York’s JFK, providing onward connectivity to JetBlue’s extensive JFK network.

JetBlue has made it clear under its JetForward plan that it is is working to rebuild its presence and increase dominance in its natural backyard. Think about it this way. If there was a Revolutionary War battle fought in a place that was part of what would become a free state, that’s JetBlue’s backyard.

Of course it is trying to make up for what it lost in its big Boston focus city, and it is still trying to rejigger after the end of the American partnership in New York. But we’ve seen JetBlue enter Islip and Manchester while building up Providence and Hartford. It wants to be more relevant in those places, but it isn’t going to make that happen solely with nonstop flights. That’s especially true since Breeze will drop in A220 in any city that it finds on a map.

The plan appears to be to focus on Florida and San Juan from those cities (with Hartford also getting seasonal LAX). Then to be more relevant, it needs to offer that connectivity. And how it is doing that? Well, JetBlue is create a stealth hub in its focus cities of Boston and New York/JFK.

Let me explain. Let’s look in JetBlue’s backyard and expand it a little, call it north of the Mason-Dixon Line and anything from the Indiana-Ohio border toward the east. I’m also going to throw in Washington, DC, and you’ll see why in a second. These are all the routes from those cities that go to or from the Boston or JFK hubs:

July 2025 map via Cirium

Now, of this group in here, JetBlue has only single daily flights a handful of the markets. I’m going to exclude Martha’s Vineyard, Nantucket, and Hyannis because those are destinations with no origin traffic. Excluding those, the following routes have single daily ops:

- Boston – Halifax, Islip, Presque Isle, Syracuse

- JFK – Detroit, Hartford, Pittsburgh, Providence, Syracuse, Washington/National

Some of these are new markets while others are not, but they all share something in common. Every single one leaves the Boston hub between 8 and 9pm or the JFK hub between 9pm and 11pm and stays overnight, coming back early the next morning.

This pattern does a couple of things. First, it makes it easy to connect through the hub to the south, especially those Caribbean destinations that have a morning down, afternoon back pattern. (It is not good for Europe, of course.) Second, it frees up space in the congested hubs and finds the airplanes a cheaper place to sleep overnight.

In a sense, these flights are catch-alls for people who live in those cities and want an easy way to get to places they can’t fly nonstop on any airline. JetBlue can go to the most important places nonstop, but then it can add utility by finally offering sensible connections.

JetBlue has hit a lot of low-hanging fruit since the new management team took over, but now we’re getting into smaller-ball type of moves. That just makes them more interesting.